![]()

As a content marketer serving the financial services industry, I read a lot of research studies designed to uncover the effective B2B marketing trends. But almost all of them target horizontally. If they include a financial services segment, it’s unclear what kinds of companies are included. It could include everything from bookkeeping services to payment processors to investment banks. The research is rarely directly relevant to the capital markets segment of the financial services industry.

Research on the Financial Technology Buying Process

A recent study by public relations firm CCgroup is a refreshing exception. CCgroup looked into how financial institutions make large technology investments. The study describes the kinds of information needed by buyers at each stage of the buying process and includes recommendations about how technology vendors can meet those needs.

This research stood out for me because it’s the first I’ve seen (other than PropelGrowth’s) that focuses exclusively on the financial services vertical. Also, the size of the transactions described in CCgroup’s research study are similar to those advanced by PropelGrowth’s client base.

Demographics

Demographics

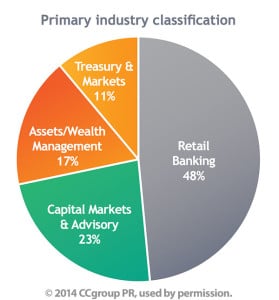

The demographics don’t line up exactly with the target audience for most of our clients, as only 23% are in the capital markets, but the research is still more significant to our industry than other generalist reports that lump all financial services respondents into one demographic group regardless of what business they’re in. In all cases, the companies included in the study employ more than 25,000 people, and 65% of the technology investments they discussed were valued in excess of $1MM USD.

Methodology

For this research, CCgroup interviewed executives within financial services companies in the US and the UK. Researchers conducted 67 in-person interviews with decision makers, including many C-level executives. They were asked what mattered most to them at different stages of the technology buying cycle.

Buying Committees Involve More Than 10 People

The first result that leapt out at me was the number of people involved in the buying process. 52% of respondents said that IT decisions involved 10 or more people. 15% said the decision involved 50 or more people.

I find that FinTech sales and marketing teams are often unaware of the complexity of the decision process taking place behind closed doors. Buyers need content to inform their decision process, but most FinTech firms are not providing the information and insights they need. Marketers need to do more work to understand their customers’ buying process and all the different roles played in the buying committees. This is the only way Marketing can provide the content that these committee members need to inform their decision process and advocate for your products internally.

Preparing the Long List of Solution Options

The study begins with the process of “long listing,” in which financial institutions gain a familiarity with potential technology solutions. I believe that this is actually closer to the middle of the customer’s buying process. Earlier stages focus on identifying and defining the problem. We call the first stage “Awareness” and the second stage “Research.” The Long listing roughly corresponds to the second half of the Research Stage. You can read more about how content marketing can facilitate the buying process in our e-book, “The 4 Stages of the Financial Technology Buying Process.”

According to the research, the most important influencer in the long listing process is the internal business analyst. Yet few content marketing strategies deliberately target this buyer persona, opting instead for C-level executives or managing directors.

These internal analysts are charged with investigating new technologies and business processes, based in part on information they obtain from industry analysts and trade publications. Other top influencers in this stage of the process include existing relationships with a vendor, the opinion of industry analysts, and observations by industry peers and consultants. Your content strategy should target these influencers with the goal of building awareness and advocacy amongst their the internal analysts’ peers in the industry.

Narrowing Down the Short List

The second stage described in the research study is short listing, where the buying committee narrows the list of vendors in preparation for formal evaluations. This stage is similar to the Evaluation Stage in PropelGrowth’s buying process model. At this stage, buyers are looking to understand what capabilities the vendors provide. They need evidence that the vendors can meet their business needs, and clarity on how the various options are differentiated. For a vendor to stand out and make the short list, it needs to demonstrate a clear understanding of the buyer’s business, sufficient flexibility to meet the buyers’ unique needs, and a sound industry reputation.

In addition, at this stage, the research indicates that buyers value unique insights that challenge their thinking about a problem or solution. But it’s important to remember that buyers need to clearly understand the capabilities that your product provides in addition to seeing your thought leadership. There is an important distinction between content marketing and thought leadership. Both are absolutely necessary, but neglect the former in favor of the latter at your own peril.

Making the Commitment

The third and final stage covered by the study is Purchasing. At this point, the nature of the conversation between the financial institution and the FinTech vendor changes dramatically. The buyer is no longer looking for industry reputation or differentiation from peers. Instead, buyers need the vendor to provide hard evidence that they can meet the buyer’s specific needs within a reasonable budget and timeframe. This is comparable to the Commitment stage in PropelGrowth’s buying process model.

This is often the most difficult part of the buying process for the customer. They’re looking for proof that they’re making the right decision. The most important content a vendor can provide here is evidence that it has experience in delivering a similar solution to similar companies. Customer references and detailed case studies are important. Industry feedback around quality, reputation, support, and implementation efficiency are also highly valued. Marketing materials designed to support the purchasing stage should help the buyer understand the implementation process, know what to expect in terms of migration, and provide insight into how they can manage risk.

According to CCgroup, buyers say they rarely receive sufficient information at this stage; but that when they do, “it can make the difference between a shortlisting and winning the business.”

The Importance of Buyer Personas

The CCgroup research describes a structured and nuanced process for making financial technology investments. When 10 people or more are involved in a buying decision, they all have different priorities and need different information to make an informed decision. FinTech marketers must do the research to understand the needs of each of these buying committee members in order to provide the content they need at each stage in the buying process.

The study concludes, “CCgroup believes that, armed with the right intelligence, vendors can build marketing communications strategies that will give them an advantage over their competitors and deliver more sales.” I strongly agree.

Pie chart image courtesy of CCgroup PR.

6 responses to “How Financial Institutions Buy Technology”

[…] targeting makes it much more straightforward to create highly relevant content. Research shows that buying committees in large financial institutions often include more than 10 people. So having a small group of accounts with very similar needs will make it easier to prepare content […]

[…] areas (for the large firms), with 3-5 target buyer personas in each region (although if you read this article, you may decide you need more personas). So that’s roughly 5,000 to 7,500 […]

[…] few weeks ago, I blogged about a recent study on how financial institutions buy technology. The study interviewed key senior-level buyers at financial institutions with more than 25,000 […]

[…] strategists view content marketing not only as a lead generation tool, but as a tool that helps facilitate every stage in the buying process. That means helping to arm internal advocates so they can build consensus in their […]

[…] LIKELY to be downloading your white papers, reviewing your website and researching their options. Research has proven that buying committees rely on internal analysts to create the shortlist. CXOs and decision-makers […]

[…] Industry issues that are driving change and influencing the buying process […]