![]()

I do a lot of buyer persona interviews on behalf of our clients. One area we continually focus on is understanding the kinds of content buyers need as they progress through their buying process. I’m particularly interested in understanding what kinds of information buyers need to decide which companies to long-list and then shortlist.

Most marketers are trying to optimize the customer experience, but we often miss the key things that buyers need most at this stage. So I thought I’d share some buyer frustrations in hopes that it gives you a sense of what your buyers might need to see that’s missing from your website and sales materials.

Buyer Frustration Starts with the Search

Generally, there are several people doing the research, trying to compose a “long-list” – an exhaustive list of potential options for solving their problem. Buyers tell me consistently how frustrating it is to use Google to discover and learn about vendors during this long-listing process.

First off, it’s difficult to find potential vendors, because buyers don’t know what keywords to use. At this point in their process, they have a reasonably good sense of their business problem, but they’re not sure how to describe it in a keyword search. So they fumble around, trying a variety of search phrases. The search results help them refine their search strategy, but even then, surfacing vendors with viable solutions is difficult. It’s not about them not trusting vendor content. It’s about them not being able to find the vendors in the first place.

Here’s a quote from an evaluator at an asset management firm who was looking for software to help create fund fact sheets: “The Google search was frustrating. I started out looking for marketing automation vendors. But that surfaced a lot of companies that didn’t do anything related to what we needed. So I modified my search. Then I’d find vendors that might be directly or tangentially related to the problem, but when I visited their sites, I found it hard to dig deep enough to see if they actually provide what we needed.”

Another buyer said, “We had a very specific use case, and I had to do quite a bit of due diligence before I could even know if a specific vendor offered what we need.” In other words, they had to do due diligence just to decide whether the vendor belonged on the long-list.

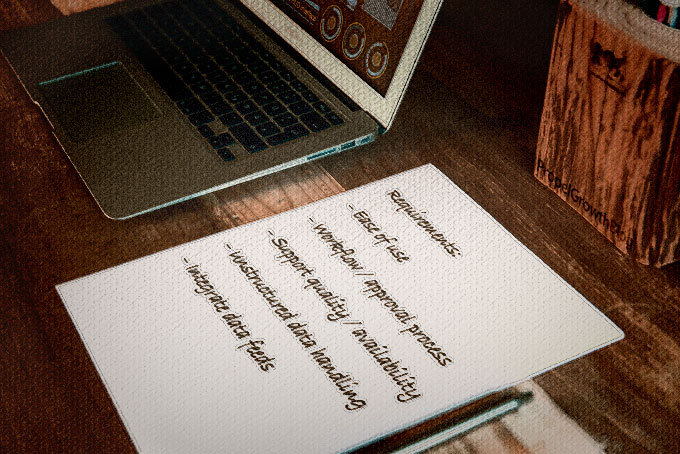

I understand this pain. I’ve run into the same problems when looking for technology solutions for PropelGrowth. It’s hard to tell how many qualified vendors I’ve dismissed just because I didn’t find them at all, or their content was so vague that I couldn’t quite figure out whether their offering would meet my need.

In some cases, this is because the product offering is esoteric, but in most cases, it’s because the vendor’s site doesn’t clearly explain what its products do and how clients use them to solve business problems. This is particularly true with those highly visual sites that have lots of pretty pictures but not much text. Don’t lean so far toward the visual web that you fail to help your potential customer understand what you offer.

How Buyers Find Potential Solutions

So most buyers give up on Google and use other methods to surface solutions, including word of mouth, talking to colleagues who recently joined from other firms, researching what competitors are using, and social media. Buyers consistently use at least 3 to 4 methods to surface vendors for their long-list.

One buyer long-listed 7 vendors, which he sourced with various methods. “Some were vendors that people had heard of before or used before in previous jobs. One or two were surfaced by spam [a.k.a. the vendor’s email marketing campaigns], and one or two were surfaced by Google search.”

Another interesting approach this buyer took was to look at competitor-published materials and news releases naming competitors to see what vendors they’re using. So Marketers, keep publishing those press releases naming new customer wins. But be clear in the press release about what the customer bought.

Whittling the Short-List

Once the comprehensive list is prepared, they’ll start researching the vendors on the long-list to disqualify as many as possible, with the goal of whittling down the list to 3-5 vendors on a short-list that they can more carefully evaluate.

But this whittling process is very difficult for buyers, because vendors don’t provide enough insight to correctly evaluate them. One buyer said, “I wanted to see what they did and what the process would be for using their product, but most vendors don’t offer enough depth on their website, so we couldn’t get that basic information without getting into a deeper relationship with the vendor’s sales person and seeing a demo.”

Some tech vendors do this intentionally, thinking that they can convert more leads into sales opportunities if they just get a chance to show the lead a live demo. Marketers – this approach serves NO ONE well. It wastes the prospect’s time, and it also burns valuable sales resources. You’re better off helping a prospect disqualify themselves based on information on your website, so Sales can focus on opportunities that are better qualified.

Evaluating the Short-List Options

Generally, there is a primary evaluator and a technical reviewer involved in whittling down the long-list to produce the short-list. The evaluator’s job is ensuring that the product meets the business needs and that the firm can actually use it. The technical reviewer evaluates for the technical side to verify that it will work in their environment and can integrate as needed. Note to Marketers – these are not CXO level people. They generally represent the people in the organization experiencing the pain first-hand. Your content for this stage in the buying process needs to give the depth of information necessary for these people to do their evaluation thoroughly.

These evaluators are trying to understand how they would address specific needs and use cases. One buyer said, “Our firm tends to look at things based on workflow and use cases. For example, if I wanted to do this workflow, how would it work in this product? I would like to see 3-5 minute videos demonstrating that.”

Another buyer said, “A lot of vendors want to provide a live demo because they think they have more control, but there are times when we’d like to see a 3-5 minute video on our own time before we commit time to a 1-hour demo.”

These evaluators need to have a solid sense of what the various options will do in order to justify their short-list decisions. But few websites go into this depth. You can force the buyer to talk to Sales to get the information at this point, but you risk getting de-listed instead. Better to provide the information they need with clear calls to action that invite discussions with your sales team.

Your Website Must Answer Their Questions

Ok, so as a Marketer, how do we evaluate whether our website actually answers the questions these buyers are asking? Here are three surefire approaches, and if you use all three to inform your content strategy, you’ll be heading in the right direction.

- Interview your customers, especially those who just recently made their decision. Specifically, interview the people tasked with defining the long-list and short-list. Talk to both the user representative and the technical evaluator. Find out what information they were looking for, what questions they needed to answer, what search criteria they used, what they found, where they were frustrated, and which vendors did the best job answering their questions.

- Collect all RFPs and RFIs (request for proposals/request for information) received by your sales team, and all the responses. Dig through these to see what questions are consistently cropping up, and start answering them on your website or in mid-funnel content that Sales can send to prospects. This will help ensure that you don’t miss out on the short-list because of a lack of available information.

- Interview recent lost sales. Ask them the same questions. Try to find out exactly what their criteria were and where they think your firm fell short. In my experience, lost deals fall in three categories. Try to determine which one they fall into, so you can evaluate their responses in the correct light.

- A competitor met more of their spoken and unspoken needs than your firm.

- They misunderstood what you offer and based their decision on incorrect assumptions.

- They were just trying to justify a decision they had already made (to go with a competitor or build internally).

To the best of your ability, put yourself in your customers’ shoes and look at your site and your competitors’ sites from their point of view. Can you find what they would be looking for as they compile their short-list? If not, make the needed changes, and your conversion rates will improve.

As you work on this, here are some resources that might prove helpful:

Buyer Persona Template

Facilitating the Buying Process at Financial Institutions

- 4 Steps to Optimize Your LinkedIn Profile for Sales Prospecting – February 12, 2021

- The Reality of Cold Calling for B2B Sales – January 11, 2021

- Can Inbound Marketing Generate Enough Leads? – January 9, 2021